The foundry industry is experiencing a polarized landscape, with a surge in demand for advanced process nodes and challenges from trade tariffs, as TSMC maintains its position as the leader.

- High demand for advanced process nodes

- Record-breaking revenue for top 10 foundries

- TSMC cementing its position as industry leader

Foundry Industry Trends: A Polarized Landscape

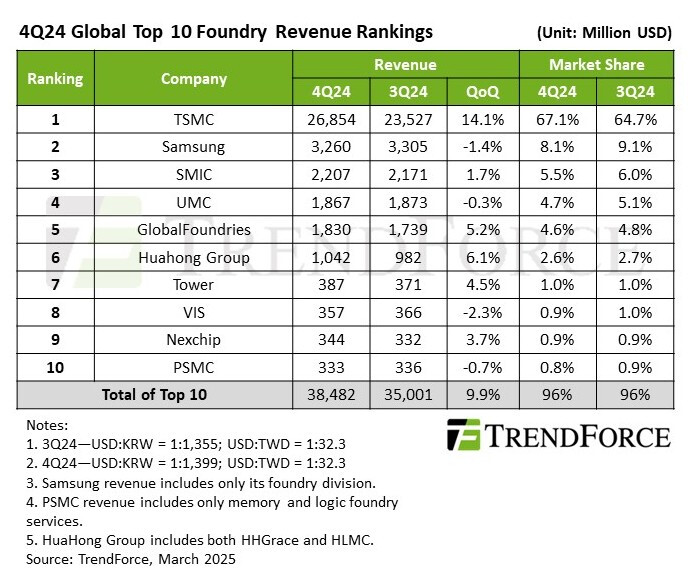

The latest research from TrendForce paints an intriguing picture of the global Foundry industry as we wrap up 2024. It turns out that while the market is experiencing a bit of a polarized trend, there’s still a silver lining for some players. The advanced process nodes are riding high on a wave of demand, thanks to the booming sectors of AI servers, smartphone application processors (APs), and fresh PC platforms. This surge has driven high-value wafer shipments, effectively balancing out the slower demand for more mature processes. In fact, the top 10 foundries saw a nearly 10% quarter-over-quarter revenue growth, reaching an impressive $38.48 billion—a new record for the industry!

Trade Tariffs and Consumer Demand: A Double-Edged Sword

However, it’s not all smooth sailing. TrendForce highlights that new U.S. trade tariffs, a legacy of the Trump administration, are starting to leave their mark on the foundry landscape. Interestingly, there’s been a noticeable uptick in orders for TVs, PCs, and notebooks destined for the U.S. market in Q4 2024, a trend that’s expected to carry over into Q1 2025. On top of that, China’s consumer subsidy program, introduced late last year, has prompted upstream customers to restock their inventories early. So, even though Q1 is typically a quieter season, the persistent demand for TSMC’s AI-related chips and advanced packaging suggests that foundry revenue will only dip slightly.

TSMC: The Uncontested Leader

Leading the pack is TSMC, which saw its wafer shipments grow quarter-over-quarter, boosting its revenue to a staggering $26.85 billion. With a commanding 67% market share, TSMC is firmly cementing its status as the industry leader. Meanwhile, Samsung Foundry came in second, though it faced a slight revenue decline of 1.4% QoQ, landing at $3.26 billion and capturing an 8.1% market share. The dip in revenue can be attributed to new advanced-node customers not fully compensating for the loss of orders from major existing clients.

SMIC and UMC: Navigating Challenges

On the other hand, SMIC encountered some customer inventory adjustments that led to a decline in wafer shipments. However, the ramp-up of new 12-inch capacity and an optimized product mix helped cushion the blow, resulting in a 1.7% QoQ revenue increase to $2.2 billion and a 5.5% market share, securing the third position.

UMC also had a decent quarter, benefiting from customers front-loading orders, which kept capacity utilization and shipments above expectations. Despite a minor 0.3% revenue drop to $1.87 billion, UMC managed to stay strong in fourth place.

Rounding Out the Top 10: Nexchip and Beyond

As we look further down the list, GlobalFoundries maintained its fifth-place ranking with a 5.2% QoQ revenue growth to $1.83 billion, although slight ASP declines did temper the growth. HuaHong Group ranked sixth, with a solid 6.1% increase in revenue to $1.04 billion, thanks in part to better capacity utilization in its 12-inch fabs.

Tower Semiconductor held on to its seventh place with a 4.5% revenue bump to $387 million, while VIS faced a 2.3% decline to $357 million due to a dip in consumer demand, even as ASP growth provided a bit of a cushion.

Among the top 10 foundries, Nexchip was the only company to shift rankings this quarter, moving up to ninth place with a 3.7% revenue growth to $344 million. Despite facing weaker demand for panel-related DDI, its CIS and PMIC shipments kept the momentum going. Unfortunately, PSMC fell to tenth place, grappling with softer demand for memory foundry and consumer-related chips. Nevertheless, on a full-year basis, PSMC’s total revenue still edged out Nexchip’s.

Looking Ahead: What’s Next for Foundries?

As we step into 2025, it’s clear that the foundry industry is in a state of flux, balancing challenges and opportunities. With ongoing demand for advanced chips and the impact of trade policies, it’s going to be fascinating to see how these dynamics unfold. Will TSMC continue to dominate, or will other players find their footing? Only time will tell, but one thing is for sure: the foundry landscape is one to watch closely.

About Our Team

Our team comprises industry insiders with extensive experience in computers, semiconductors, games, and consumer electronics. With decades of collective experience, we’re committed to delivering timely, accurate, and engaging news content to our readers.

Background Information

About GlobalFoundries:

GlobalFoundries is a semiconductor manufacturing company founded in 2009 by Advanced Micro Devices (AMD). Headquartered in Santa Clara, California, with major manufacturing facilities in the United States, Germany, and Singapore, GlobalFoundries has established itself as one of the leading players in the global semiconductor industry. With a focus on providing innovative solutions for a wide range of applications including mobile, automotive, and IoT devices.

Latest Articles about GlobalFoundries

About Samsung:

Samsung, a South Korean multinational conglomerate, has established itself as a global leader in various industries, including electronics, technology, and more. Founded in 1938, Samsung's influence spans from smartphones and consumer electronics to semiconductors and home appliances. With a commitment to innovation, Samsung has contributed products like the Galaxy series of smartphones, QLED TVs, and SSDs that have revolutionized the way we live and work.

Latest Articles about Samsung

About Tower Semiconductor:

Tower Semiconductor, also known as TowerJazz, is a global semiconductor foundry company that provides advanced analog and mixed-signal process technologies. Founded in 1993, Tower Semiconductor is headquartered in Migdal HaEmek, Israel, and operates multiple manufacturing facilities worldwide. The company offers a wide range of specialized semiconductor manufacturing services, including CMOS (Complementary Metal-Oxide-Semiconductor), RF (Radio Frequency), power management, and more. Tower Semiconductor serves various industries such as consumer electronics, automotive, industrial, medical, and aerospace by producing custom-designed chips and integrated circuits. Tower Semiconductor is for its expertise in specialty semiconductor manufacturing, enabling the production of chips with unique features and capabilities. The company's focus on analog and mixed-signal technologies caters to applications that require precise signal processing and connectivity. Their collaborative approach with clients often involves developing tailored solutions to meet specific requirements, positioning them as a reliable partner in the semiconductor manufacturing industry.

Latest Articles about Tower Semiconductor

About TSMC:

TSMC, or Taiwan Semiconductor Manufacturing Company, is a semiconductor foundry based in Taiwan. Established in 1987, TSMC is a important player in the global semiconductor industry, specializing in the manufacturing of semiconductor wafers for a wide range of clients, including technology companies and chip designers. The company is known for its semiconductor fabrication processes and plays a critical role in advancing semiconductor technology worldwide.

Latest Articles about TSMC

About UMC:

United Microelectronics Corporation (UMC) is a important semiconductor foundry company founded in 1980 by Robert Tsao and others. Headquartered in Hsinchu, Taiwan, UMC has become one of the world's leading semiconductor manufacturing companies, specializing in the production of integrated circuits (ICs) for a diverse range of applications, including consumer electronics, telecommunications, and automotive industries. UMC operates several advanced manufacturing facilities across Taiwan, mainland China, Singapore, and Japan.

Latest Articles about UMC

Technology Explained

Foundry: A foundry is a dedicated manufacturing facility focused on producing semiconductor components like integrated circuits (ICs) for external clients. These foundries are pivotal in the semiconductor industry, providing diverse manufacturing processes and technologies to create chips based on designs from fabless semiconductor firms or other customers. This setup empowers companies to concentrate on innovative design without needing substantial investments in manufacturing infrastructure. Some well-known foundries include TSMC (Taiwan Semiconductor Manufacturing Company), Samsung Foundry, GlobalFoundries, and UMC (United Microelectronics Corporation).

Latest Articles about Foundry

Trending Posts

KUNOS Simulazioni introduces Major Assetto Corsa EVO Updates in Latest Video

T-CREATE P31 Portable SSD: Unleashing Infinite Inspiration with 2025 iF Design Award Triumph

“Windows 11 Insider Program Embraces Latest Update KB5055627, Unveiling Enhanced Features”

G.SKILL introduces 128GB DDR5 Overclocked Memory Kit, Setting New Standards at DDR5-8000

QNAP and Network Optix join forces for a seamlessly integrated Nx Witness surveillance storage solution.

Evergreen Posts

NZXT about to launch the H6 Flow RGB, a HYTE Y60’ish Mid tower case

Intel’s CPU Roadmap: 15th Gen Arrow Lake Arriving Q4 2024, Panther Lake and Nova Lake Follow

HYTE teases the “HYTE Y70 Touch” case with large touch screen

NVIDIA’s Data-Center Roadmap Reveals GB200 and GX200 GPUs for 2024-2025

Intel introduces Impressive 15th Gen Core i7-15700K and Core i9-15900K: Release Date Imminent